Background

Tranglo Business API is a cross-border payout API that allows Corporate Customer or E-Customer (“Partners”) to perform payout to multiple channels (bank, bank skn, payment card, real time transfer) and countries.

Partners shall comply with Tranglo Business API technical specification and development parameters to use Tranglo Business. With Tranglo Business, Partners can easily payout to relevant Beneficiary in supported country in real-time manners.

Integration Procedure

Partners need to clear a set of procedures and test before live transaction can be conducted. Tranglo Business will cooperate with Partners or E-Partners to complete the following defined tasks.

a. Technical/Commercial contact and system documentation

Partner’s documentation with following details

- At least two (2) Technical person and two (2) Commercial person contact information

- Partners System specification

- Partners AMLA and KYC compliance/procedure

b. Computer infrastructure preparation and readiness

Partners should prepare adequate server, computers and equipment to connect to Tranglo Business for transaction. Partners / E-Partners shall fully bear the installation effort and cost of such equipment.

c. Network Infrastructure preparation and readiness

Partners must prepare internet connection to Tranglo Business systems. Partners shall fully bear the installation effort and cost of such network link according to the standard defined by Tranglo Business.

d. Network link test

When server/equipment and network infrastructure is ready, a series of network connectivity, network latency and network uptime test will be carried out to ensure uninterrupted access link.

e. Tranglo Business Application Programming Interface (API) Development and Test

When Partners finished the API development integration, a ‘dummy’ test involving sender details, beneficiary details and verification process will be performed. Tranglo Business API uses secure HTTPS WSDL / SOAP method.

f. Evaluation of API / Application Test

Partners and Tranglo discuss and evaluate the result of Application test together. Based on the findings, Partners proceeds to fix and debug the error.

g. User Acceptance Test (UAT)

Tranglo and Partners jointly conduct an end-to-end test after all errors are fixed. If UAT is completed, Tranglo shall migrate Partners to Tranglo Business production systems.

h. Digital Signature in Production systems

Tranglo and Partners shall exchange a public/private key pairs to be used in respective production systems. The key is important to prove the identity of mutual systems. It shall follow the 3DES encryption and MD5 hashing method with yearly renewal. Please refer to Section 4.2 for more details.

i. Tranglo Business control panel training

Tranglo personnel shall train Partners personnel about the usage of Tranglo Business web-based monitoring tools and reporting. During training, Tranglo will also issue one (1) USER ID and Password to access Tranglo Business control panel and one (1) USER ID and Password for Tranglo Business Application Programming Interface (API).

j. Live transaction test

Both Tranglo and Partners conduct a live transaction involving actual Sender and Beneficiary. The test includes various successful and failed scenarios according to the pre-defined test script. If such test is cleared, Partners will be considered as Ready for Service (RFS)

k. Operational monitoring

Tranglo team will monitor the live transaction for a period of up to 30 days. Both Tranglo and Partners team communicate and feedback each other if any irregularities happen during this period. If there is any technical error, Partners need to rectify within this Operational monitoring window. If there is any financial fraud or risk not properly addressed by Partners, Tranglo may suspend the service until the risk is mitigated.

Concept Overview

- All Partners using the Tranglo Business API will be assigned with a Tranglo Partner e-wallet Account with USER ID and Password.

- Tranglo will accept Partners system request and deduct e-wallet for every successful remittance operation. A successful remittance means the fund and information is accepted by Tranglo Business AMLA/KYC policy and successfully sent from Sender Partner to the Beneficiary Partner or Banks within the agreed duration.

- Tranglo shall notify the transaction status either in asynchronous or synchronous manners dependent the Beneficiary Partner channel. All transaction is reconciled automatically with corresponding Tranglo Business Transaction Number (GTN).

- Transaction that failed to reconciled will be automatically be considered as a Dispute transaction .

- Tranglo will not execute remittance operation if e-wallet falls below the agreed minimum threshold

- Partners are expected to top up the e-wallet when the balance falls below the agreed minimum threshold to ensure smooth operation and minimum disruption.

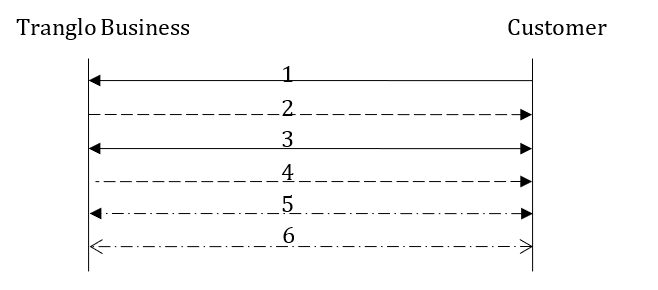

Technical Overview

- Partners will check the validity of a beneficiary account via SOAP method Get_Validation (if applicable) or current forex rate via method Get_Forex

- Tranglo Business reply Partners with the beneficiary account details (including account holder name) and its validity or the current applicable forex rates.

- Partners confirm money transfer transaction request via SOAP Method Do_Transfer to Tranglo with the relevant parameters

- Tranglo acknowledge Partners request and notify the confirmed transaction status within 180 seconds.

- Partners can use Get_TrxStatus SOAP method to check transaction status if network timeout or other error occurs.

- Partners can initiate server warm-up or keep-alive with SOAP Method Ping from time to time

- Please note all the data sent to server MUST be properly URL Encoded.

- Partners must supply Tranglo Technical team with a FIXED IP address to allow access into the web service applications