Buy now, pay later (BNPL) has become such a norm in the B2C scene that it may be harder to find a platform without such a payment model. BNPL allows buyers to purchase anything without paying in a lump sum when they check out, with instalment options over 3 to 6 months depending on the amount.

BNPL is also gaining popularity in B2B, notably during the Covid-19 pandemic when B2B shifted online en masse. BNPL in B2B serves the same purpose as in B2C, where B2B buyers get flexible repayments, allowing them more control over cash flow.

The concept of BNPL in B2B is similar to trade credit traditionally used for national and international financing agreements. Under trade credit, buyers pay for goods or services over 30, 60 or 90 days. However, trade credit benefits the buyer more; it is less favourable to merchants as it may lead to issues with cash flow.

That’s where BNPL providers come into the picture. In a B2B BNPL transaction, buyers still enjoy the split payments benefit, while sellers get paid upfront from the BNPL providers, reducing the risk of trapped capital.

Globally, over USD 30 billion of B2B sales occur yearly on credit terms, meaning many businesses use BNPL without realising it. Also, the B2B trade market is 2.5 times larger than B2C, which shows that B2B BNPL has vast potential.

BNPL is a viable business tool for small and medium-sized businesses (SMEs) that might need help managing cash flow. More than 50% of B2B marketplaces have or plan to adopt BNPL financing solutions.

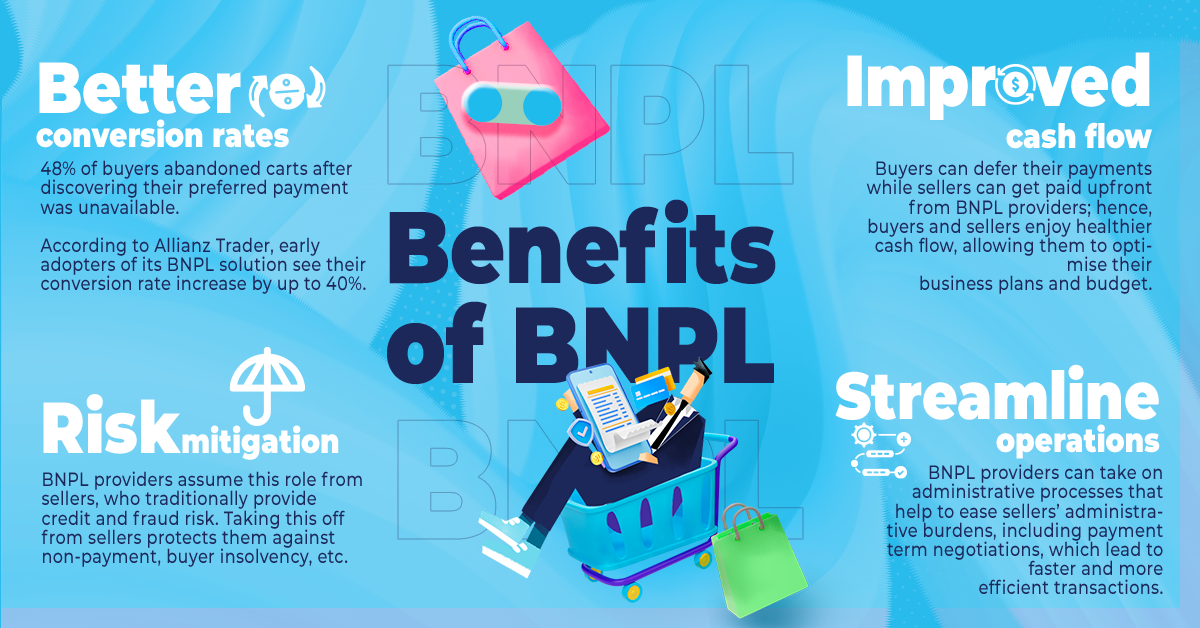

Benefits of BNPL

BNPL in cross-border payments

In the cross-border payment industry, Ripple’s On-Demand Liquidity (ODL) plays the role of a B2B BNPL provider.

Introduced in 2018, ODL improves cross-border payments by eliminating pre-funding and improving settlement speed using the XRP as a bridging currency. This is a game-changer in an industry traditionally associated with expensive, slow and opaque transactions.

Here are some use cases:

Ripple x MoneyMatch

Ripple enables MoneyMatch, a Malaysian fintech company that services SMEs and individuals, to connect with financial institutions and payment providers worldwide. According to Ripple, ODL has helped the company reduce global transfer costs by as much as 40% and provide customers with same-day settlements.

Ripple x I-Remit

I-Remit, the largest Filipino-owned non-bank remittance service provider, managed to reduce cross-border payment costs for remittance partners and customers after partnering with Ripple. I-Remit also uses ODL for its internal treasury, which has enabled 24/7 access to liquidity, reducing its need to pre-fund destination accounts.

Ripple x Tranglo

Since partnering with Ripple, Tranglo has gained access to more than 100 financial institutions and partners globally. ODL has allowed Tranglo to create a payment superhighway on top of RippleNet, linking remittance customers to a flexible settlement model that drives transaction growth.

Conclusion

BNPL is a popular financial tool for B2C and B2B sectors. Digital assets and blockchain are improving the BNLP model in the cross-border payment industry, giving businesses greater financial control and efficiency.

ODL, a “BNPL” model, helps cross-border payment businesses by reducing transfer time. It also gives remittance businesses more control over their capital. Talk to us to learn more.