If you run a cross-border business or a remittance service, you might be familiar with the term “multi-currency wallet”. Simply put, it helps a business or individual hold and transact in multiple currencies within the same platform.

A multi-currency wallet is an important part of an international business transaction. According to Statista, the USD and the euro are the most commonly used currencies for a SWIFT payment. If you are on any currency other than the 2, you can either engage a payment service provider that helps you switch currencies or do it manually.

Whichever option you choose doesn’t change the fact that a multi-currency wallet can switch between payout currencies efficiently, quickly and automatically.

Multi-currency wallet simplifies cross-border transactions

What are the top benefits of a multi-currency wallet?

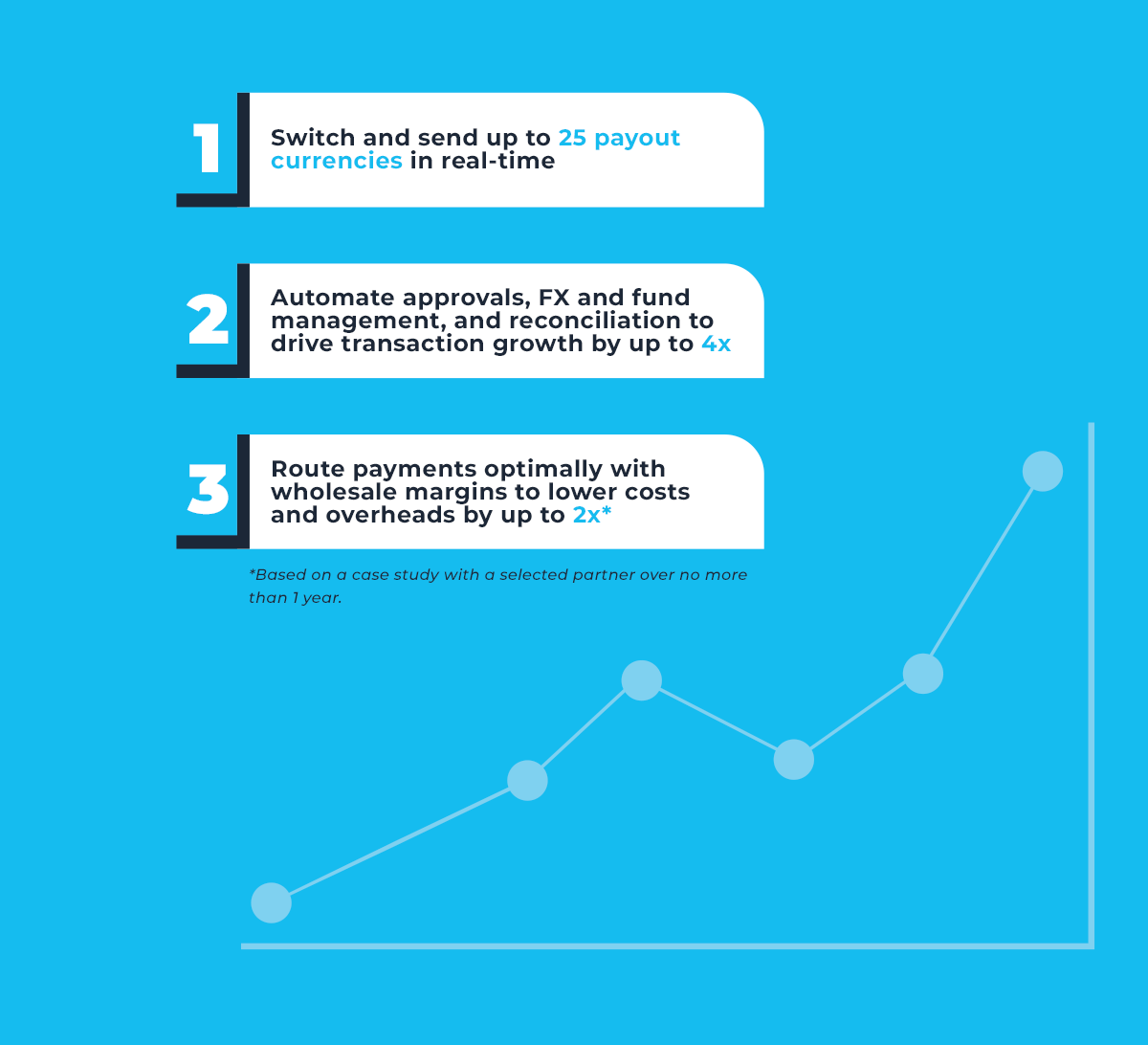

Firstly, a multi-currency wallet helps to reduce the cost of remittance. Traditionally, sending money to or receiving money from another country involves a few layers of FX spread that factor into intermediary transaction fees. By holding multiple currencies, a multi-currency wallet reduces the need for frequent currency conversions and, subsequently, the cost stemming from the conversion process.

Secondly, a multi-currency wallet enables automation and increases the efficiency of cross-border transactions. It has been reported that 28% of businesses still process their transactions manually, which is a leading cause of fraud and data-entry errors. By switching currencies on the fly, a multi-currency wallet can increase transaction count, allowing a business to process more while reducing the rate of failed transactions.

A multi-currency wallet simplifies the cross-border process by becoming a bridging platform for users to send funds in the recipient’s local currency, track their transfers and monitor exchange rates.

Tranglo’s multi-currency wallet for cross-border payments

Tranglo’s multi-currency wallet can optimise your cross-border payments by reducing operational costs and speeding up the transaction process. To know more, contact us today.