More than 1 billion people, or 1 in 7 people around the world, are involved in either sending or receiving international money transfers. Many of these transactions were processed digitally. Valued at over USD 8 trillion in 2022, digital payments are projected to enjoy 20% growth annually in the next 7 years.

Yet, digital conveniences come with tradeoffs - with greater digitalisation comes greater vulnerabilities. Studies have shown that financial crimes such as fraud, identity theft, scams, money laundering and terrorist financing, have increased because of digitalisation. An IMF study said cyberattacks caused some USD 100 billion in losses to financial institutions.

Here are 5 cybersecurity measures that can be implemented to protect cross-border transactions.

1. Encryption

This feature ensures that the data exchanged during a transaction is encrypted and cannot be intercepted by malicious players. An Aite Group study shows that 80% of users think that technology encryption is a significant feature for online money transfers.

2. Multi-factor authentication

Extra identification confirmation adds an extra layer of security. It can be an OTP request, biometric authentication (face scan or fingerprint) or others.

3. Secure APIs

Similar to encryption, this is also essential to protect data exchange between payment systems, whether it is between the company system with banks or other intermediaries.

4. Regular audit

Periodical checks and assessments can identify vulnerabilities in the payment system. Besides preventing exploitation, it allows IT specialists to keep the system updated and secure.

5. Employee training

Proper training and awareness building can empower employees to understand the importance of cybersecurity, watch out and not be deceived by phishing attempts and discourage them from sharing sensitive data.

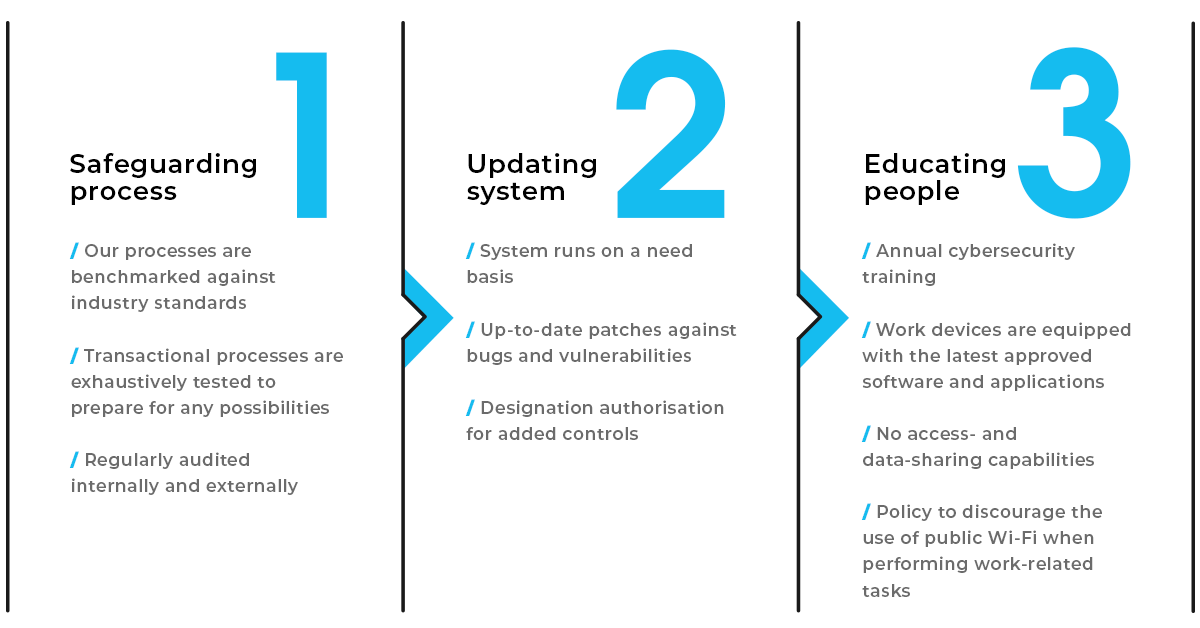

Tranglo’s 3-point cyber resilience

Blockchain to improve cybersecurity?

This is more for the immediate future. We have talked about blockchain and its benefits. In cybersecurity, its decentralisation nature makes it more resistant to cyberattacks. Unlike traditional systems that rely on central authority to manage and control data, data in a blockchain is stored and verified across multiple network nodes. This will enhance cybersecurity, as there is no central point of vulnerability. It also provides a secure and tamper-proof record of transactions. Everyone on the network can verify and audit the transactions, guaranteeing that the records are accurate and secure. This will greatly reduce the possibility of fraudulent activities as malicious actors will be detected quickly.

However, integrating blockchain technology isn’t without its challenges. From the lack of standardisation among blockchain platforms (payments need to move seamlessly between sender and receiver) to costs (staff training and infrastructural investment), there are some ways to go before widespread adoption. Even then, traditional players in the finance industry are extremely entrenched, so it may be hard to convince them to adopt what is perceived as high-risk tech.